Presentación en el 19th International Joint Conference CFE-CMS-Statistics, London 2025

🚨 New Open Access Publication!

Proud to share our latest research in Research in International Business and Finance:

“Measuring the impact of climate transition risk on the systemic risk: A multivariate quantile-located ES approach”

👉 Read it here

https://www.sciencedirect.com/science/article/pii/S0275531925003836?via%3Dihub

🌍 What happens to financial stability when economies shift toward greener models?

We show that climate transition risk can significantly amplify systemic risk, especially in carbon-intensive sectors. Our model captures these effects better than traditional approaches.

📌 Why it matters:

Understanding how climate risk spreads through financial systems is key for regulators, investors, and policymakers preparing for the green transition.

Huge thanks to my co-author Laura García Jorcano for the great collaboration!

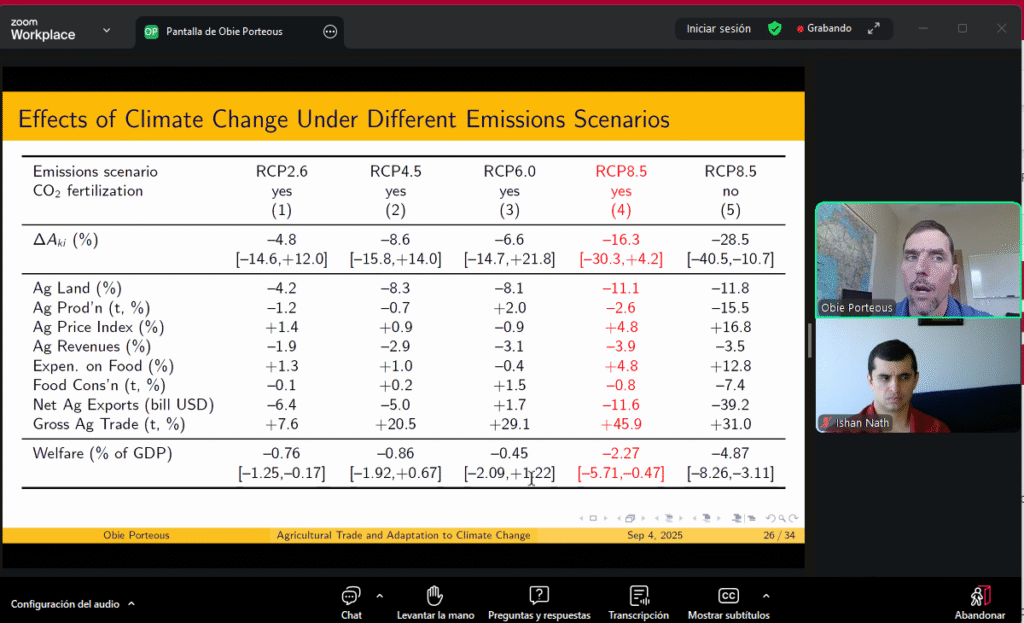

A pleasure to attend the seminar about climate economics. Thanks for the invitation.

Virtual Seminar on Climate Economics | CEPR

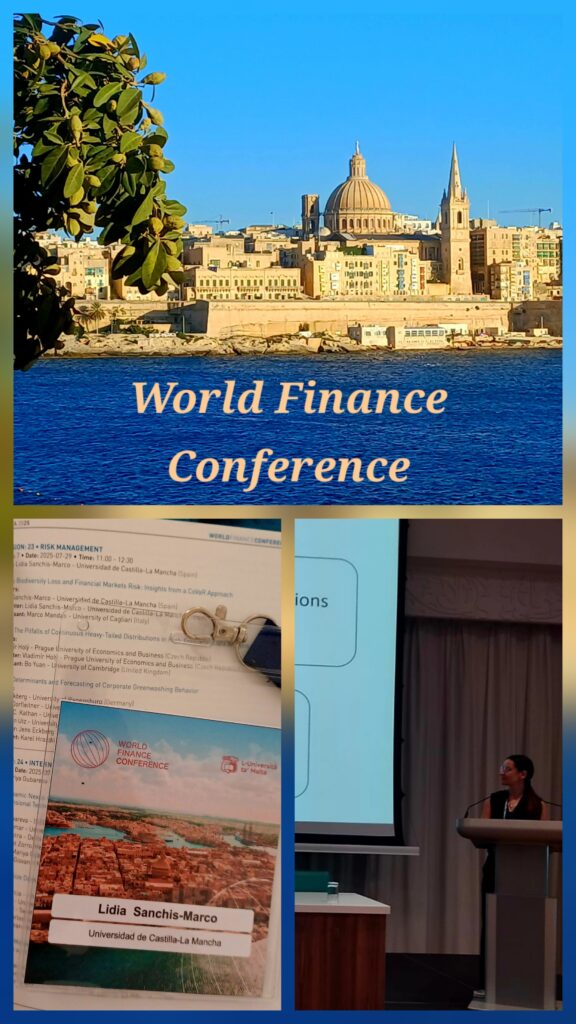

From July 28th to 31st, I had the privilege of participating in the 2025 World Finance Conference held in the beautiful city of Valletta, Malta. Representing Universidad de Castilla-La Mancha, I presented my research paper titled “Biodiversity Loss and Financial Markets Risk: Insights from a CoVaR Approach.”

Beyond the presentation, I was honored to contribute as both a discussant and a chairperson during the sessions, engaging with fellow academics and professionals in thought-provoking discussions on the intersection of environmental challenges and financial risk.

The conference provided a vibrant platform for exchanging ideas, fostering collaborations, and exploring innovative approaches to global financial issues. I’m grateful for the opportunity to be part of such a dynamic and inspiring event.

🎓 Ha sido un auténtico placer formar parte del comité organizador y científico de las XXXIII Jornadas de ASEPUMA y el XXI Encuentro Internacional que ha contado con más de un centenar de participaciones.

🤝 Gracias a Gema por su generoso ofrecimiento para integrarme en este equipo y a todos los miembros del comité por su compromiso y excelente trabajo. También quiero expresar mi agradecimiento a los ponentes invitados por sus brillantes intervenciones:

🏛️ Gracias a la UCLM y a mi Facultad de Ciencias Jurídicas y Sociales de Toledo, a las autoridades y patrocinadores que nos han apoyado para hacer posible este encuentro.

📊🧠📚 Toda una experiencia enriquecedora, que ha reforzado el valor de la docencia y la investigación en métodos cuantitativos aplicados, inteligencia artificial y divulgación científica, con una mirada comprometida hacia la equidad en la ciencia.

It was a pleasure to attend the conference organized by the Swiss National Bank, CEPR, and BIS celebrated in Zurich. Thank you very much for the invitation.

I’m thrilled to announce that our paper, «Measuring the Impact of Transition Risk on Financial Markets: A Joint VaR-ES Approach,» has been published in the Journal of Forecasting! A huge thank you to my outstanding coauthor, Laura García-Jorcano, for her dedication and teamwork throughout this journey. 🙌

In our study, we developed a novel method to forecast market risk under transition risk exposure, focusing on extreme bank returns in Europe. If you’re interested in exploring our research, you can read the full paper here:

Measuring the Impact of Transition Risk on Financial Markets: A Joint VaR‐ES Approach

Como miembro del comité organizador y científico del congreso ASEPUMA, os invito a participar en este interesante evento que tendrá lugar el 12 y 13 de junio en la Facultad de Ciencias Jurídicas y Sociales de Toledo.

Para más información: XXXIII Jornadas de Asepuma