-

Presentation at INFORMS 2020

In this link you can find my last presentation at INFORMS 2020: The Impact Of Undershoots On Determining The Fill-rate For A (s,S) System The abstract of the presentation is the following: The correct sizing of the safety stock is a paramount problem that aims to achieve a compromise between customer service level and inventory…

-

Sistemas de predicción locales asociados a hospitales

Hace unos días me topé con un artículo que llamó mi atención, el título del mismo era: “How One Boston Hospital Built a Covid-19 Forecasting System“, que se podría traducir en cómo un hospital de Boston diseñó un sistema de predicción para el Covid-19. El artículo es muy interesante por varios motivos. Primero, como experto…

-

Supply chain forecasting special issue

I am pleased to inform you that Dr. Gokham Egilmez and myself are organizing a topical collection about supply chain management forecasting to be published in Forecasting (ISSN 2571-9394). Please, see this link for further information. In case you are interested, please feel free to let either of us know.

-

Forecasting in techno-economic analysis.

Yesterday, I received by e-mail the publication details of my last collaboration with my chemical engineers colleagues. The article is entitled “Is methanol synthesis from co-gasification of olive pomace and petcoke economically feasible?” and during 50 days the access will be free (until July 27th.). This work deals with a problem very related to a…

-

Previsiones macroeconómicas

Aquellos que nos dedicamos a realizar previsiones sabemos la dificultad que entrañan. Uno de los numerosos campos del forecasting es el dedicado a la macroeconomía. En este sentido, hoy he leído un artículo muy interesante publicado en El País, https://elpais.com/economia/2020/01/24/actualidad/1579871826_023930.html y que recomiendo su lectura. En dicho artículo se comenta algo muy importante y que,…

-

New publication: “Optimising forecasting models for inventory planning”

Inaccurate forecasts can be costly for company operations, in terms of stock-outs and lost sales, or over-stocking, while not meeting service level targets. The forecasting literature, often disjoint from the needs of the forecast users, has focused on providing optimal models in terms of likelihood and various accuracy metrics. However, there is evidence that this…

-

Presentation at ISF 2019 (Greece)

One of the most important conferences, possibly the most important, about forecasting is The International Symposium on Forecasting. This year was celebrated in Tesalonika (Greece) and I had the opportunity to share with the rest of colleagues our latest advances in supply chain forecasting. This year, we presented different approaches (parametric and non-parametric) to better…

-

Workshop: Forecasting and inventory control.

It is a pleasure to inform that two members of the INTERCOL Project (Eugenia and Ester) are organising a very interesting event about Forecasting and inventory control within the 11th. International Conference on Industrial Engineering and Industrial Management that will take place in Valencia between the 5th. and 6th. of July. Note that these disciplines are typically…

-

A data-driven approach to compute safety stocks.

Supply chain risk management is drawing the attention of practitioners and academics. A source of risk is demand uncertainty. To deal with it demand forecasting and safety stocks are employed. Most of the work has focused on point demand forecasting, assuming that forecast errors follow the typical normal i.i.d. assumption. The variability of the forecast…

-

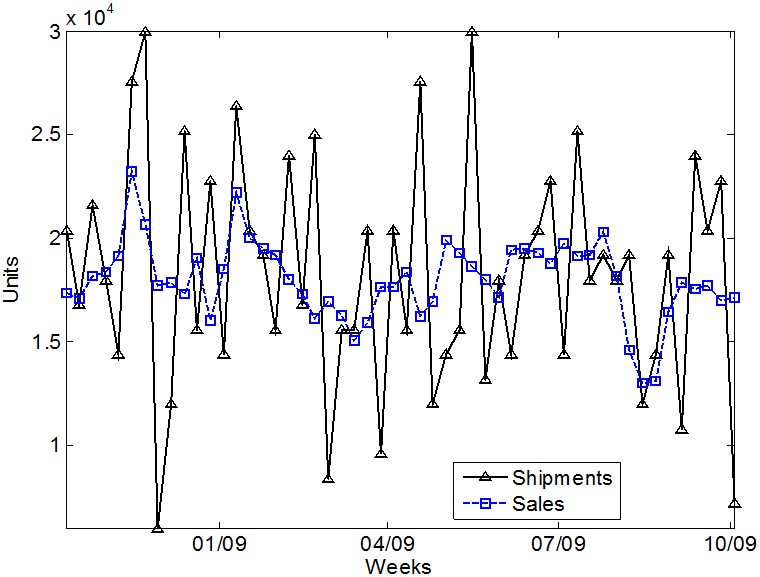

Real-time bullwhip metric

Bullwhip effect is a problem of paramount importance that reduces competitiveness of supply chains around the world. A significant effort is being devoted by both practitioners and academics to understand its causes and to reduce its pernicious consequences. Nevertheless, limited research has been carried out to analyse potential metrics to measure it, that typically are…

-

Optimal combination of volatility forecasts to enhance solar irradiation prediction intervals estimation

Please find my presentation at the ISF 2016 celebrated in Santander . As usual, it was a pleasant experience from both perspectives, personal and professional.

-

Optimal combination of volatility forecasts to enhance solar irradiation prediction intervals estimation

Please find my presentation at the ISF 2016 celebrated in Santander . As usual, it was a pleasant experience from both perspectives, personal and professional.

-

36th. International Symposium on Forecasting: Santander!

Para aquellos que estéis interesados en las artes de la predicción (forecasting), este año el congreso más importante en forecasting se celebra en Santander durante los días 19 y 22 de Junio en el palacio de la Magdalena. Podéis consultar los detalles en: https://forecasters.org/isf/ En mi opinión si trabajas en cualquier área del forecasting ya…

-

II Seminario de dirección de operaciones en la industria química

Los profesores Francisco Jesús Fernández Morales y Juan Ramón Trapero Arenas tienen el placer de anunciar el II seminario de dirección de operaciones en la industria química. Este año el seminario constará de 4 presentaciones con ponentes procedentes de diferentes empresas que nos darán su punto de vista sobre los principales aspectos de la dirección de operaciones.

-

How to compute the safety stock, Shall I use the demand distribution or the forecast demand error distribution??

Currently, I am teaching a subject about operations management and I have to introduce to my students the importance of safety stocks and the different ways to determine it. At this point, I was analyzing how this issue is explained in operations management books, and I realized that some of them compute the safety stock on the…

-

Call for papers: Special session in Energy Forecasting EURO 2015

La predicción y modelado de sistemas energéticos es crítica para optimizar la generación, control y distribución de los sistemas energéticos en diferentes países. Es un placer poder anunciar una sesión especial dedicada en el análisis de conceptos, modelos, metodologías, casos de estudio que contribuyan a enriquecer nuestro conocimiento de un área tan vital para las…

-

Call for papers: Special session in Energy Forecasting EURO 2015

Energy modelling and forecasting has become essential to optimize the generation, control and distribution processes of countries’ energy systems. This special session of the EURO confererence (12-15 July, Glasgow) calls for abstracts analyzing concepts, models, methodologies, case studies that contribute to strengthen our knowledge of such an important area. Topics of interests (but not limited to) are…

-

Short-term Solar Irradiation forecasting based on Dynamic Harmonic Regression

I am pleased to devote a few words to the new working paper that we (Alberto Martín, Nikos Kourentzes and myself) have elaborated with the collaboration of the ISFOC that kindly provided the research data. The paper reports the Dynamic Harmonic Regression applied to forecast the solar irradiance at short-term, but, why is this important?…

-

Una nueva métrica para cuantificar el efecto látigo

El efecto látigo es un problema de vital importancia que reduce la competitividad de las cadenas de suministro a lo largo del mundo. Personal académico y del ámbito empresarial están dedicando un esfuerzo sustancial para entender sus causas y así reducir sus perjudiciales consecuencias. No obstante, hay un tema que se ha pasado por alto…

-

A novel time-varying bullwhip effect metric. An application to promotional sales

Bullwhip effect is a problem of paramount importance that reduces competitiveness of supply chains around the world. A significant effort is being devoted by both practitioners and academics to understand its causes and to reduce its pernicious consequences. Nevertheless, limited research has been carried out to analyze potential metrics to measure it, that typically are…